Adopt a green growth strategy to boost the sluggish automobile sector

Published on Sep 5, 2019

Published on Sep 5, 2019

Modified on Sep 9, 2019

Modified on Sep 9, 2019

|

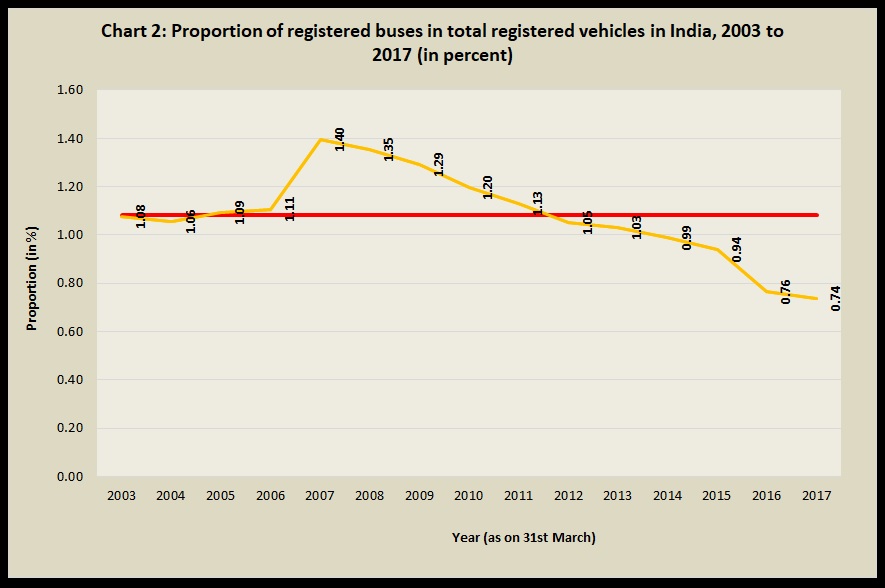

Among the measures announced by the Union Finance & Corporate Affairs Minister Smt. Nirmala Sitharaman on 23rd August, 2019 to arrest economic downturn, the following are noteworthy: * Allow Bharat Stage IV (BS-IV) vehicles (which are purchased till 31st March, 2020) to remain operational for the entire period of registration; * Government shall lift the ban on purchase of new vehicles for replacing all old vehicles by its various departments; * In order to make corporate and fleet buyers prepone their decisions to purchase vehicles, a higher depreciation has been allowed (raising it to 30 percent from the existing 15 percent); * Government will consider various measures to revive demand for automobiles including scrappage policy (for example, car buyers get government subsidies for replacing their old vehicles); * The hike in registration fee has been deferred till June 2020; The above-mentioned demand-side steps (most measures announced by the FM are supply-side in nature viz. they are basically incentives provided by the government to the private corporate sector for encouraging investment) are supposed to provide necessary impetus to the ailing automobile sector. Media reports, which also caught the attention of the Central government, mostly centered around the deceleration in production and sales of personal vehicles like two-wheelers, cars etc. Please note that the automobile industry has been observed as a bellwether of economic activity in the post-1991 years. Against the backdrop of demand deflation pertaining to automobiles, the Union government (along with active participation of the state governments) should have announced policies for stepping up investment in public transport. A higher investment in public transport (say by purchasing domestically manufactured public transport vehicles through a transparent procurement process) in addition to investment in roads, highways or Bus Rapid Transit (BRT) corridors could have rejuvenated the slackening automobile industry and ancillary units. Investment in the latter would have created additional demand for cement and iron & steel. It may be noted that prior to the recent announcements made by the FM, a draft notification was issued by the Ministry of Road Transport & Highways (MoRTH) in July this year. That notification proposed raising the registration charges on new buses from Rs. 1,500/- presently to Rs. 20,000/-, according to some news reports. In order to understand the gravity of the problem faced by the automobile sector, it is essential to look at the recent figures related to registration of vehicles. Latest data available from the Parivahan Sewa portal (https://vahan.parivahan.gov.in/vahan4dashboard/) of MoRTH indicates that for 7 consecutive months (beginning from February 2019) the registration of vehicles in the country has recorded negative growth rates (on a year-on-year basis). For example, the total number of vehicles registered in India fell from 16.73 lakhs to 15.90 lakhs between August last year and August this year, which is a decline by 4.96 percent. Please check chart-1 for details.  Source: Vahan dashboard of Parivahan Sewa portal of MoRTH, https://vahan.parivahan.gov.in/vahan4dashboard/, accessed on 5th September, 2019 --- Although Say's law states that supply creates its own demand, this may not hold true in today's economy, which is affected by lack of effective demand. The supply-side steps (like a lower interest rate on credit for manufacturers) announced by the FM last month would fail to enhance the consumption of personal vehicles because of stagnation in wages and slow growth of salaries of the working classes apart from shrinking employment opportunities and job losses. Therefore, a direct fiscal intervention by the government in the form of purchase, investment or tax incentives could have provided the required thrust to the automobile industry. A higher usage of public transport by the society has many advantages including lower levels of vehicular pollution, lesser congestion on roads and a reduction in import bill arising out of purchase of oil and petroleum products from abroad. Therefore, a green growth strategy to revive the sluggish economy could have been a better option. Research reports indicate that the leap from BS-IV to BS-VI has been a costly affair for both manufacturers and consumers of automobiles including buses. The recent measures announced by the FM may provide temporary relief (viz. the allowance of BS-IV vehicles purchased till 31st March, 2020 to remain operational for the entire period of registration) to manufacturers and consumers of vehicles. However, there is a need to safeguard our environment for a better tomorrow by investing in public transport. Perhaps it is the most opportune moment to promote public transport by our government.  Source: Annual Report 2018-19 of Ministry of Road Transport and Highways, please click here to access --- Latest available data from the 2018-19 Annual Report of the MoRTH shows that the proportion of registered buses (used as a proxy for public transport in this news alert) in total registered vehicles in India has been around 1.08 percent on an average since the last 15 years. The aforesaid proportion has fallen continuously from 1.40 percent to 0.74 percent between 2007 and 2017. The country needs safe and secure public transport systems in both rural and urban areas. Please consult chart-2.  Source: Annual Report 2018-19 of Ministry of Road Transport and Highways, please click here to access --- Chart-3 shows that the number of registered buses per 100 registered personal vehicles (which is a sum of two-wheelers, cars, jeeps and taxis) plummeted to 0.84 from 1.65 between 2007 and 2017. Table 1: Total number of motor vehicles registered in India from 2003 to 2017, CAGR (in percent) and Average Annual Growth Rate (in percent)  Note: 2017 data is Provisional * Others include tractors, trailers, three wheelers (passenger vehicles)/ LMV and other miscellaneous vehicles for which category-wise break up is not reported by State/ UT @ Includes omni buses Source: Annual Report 2018-19 of Ministry of Road Transport and Highways, please click here to access --- It could be observed from table-1 that for the period from 2003 to 2017 the average annual growth rate of buses registered (viz. 7.43 percent) was lower than the average annual growth rate of registered cars, jeeps and taxis (viz. 10.26 percent). Similarly, the compound annual growth rate (CAGR) of registered cars, jeeps and taxis (viz. 10.2 percent) exceeded the CAGR of buses registered (viz. 7.0 percent) in the country for the period from 2003 to 2017. The average annual growth rate (also the CAGR) of registered two-wheelers stood at 10.30 percent for the period 2003-2017. References Presentation made by Union Finance & Corporate Affairs Minister Smt. Nirmala Sitharaman on measures to boost Indian Economy, Press Information Bureau, Ministry of Finance, 23rd August, 2019, please click here to access Annual Report 2018-19 of Ministry of Road Transport and Highways, please click here to access Dip in tractor sales indicate further deepening of rural distress, News alert by Inclusive Media for Change dated 27th August, 2019, please click here to access Which one is a better indicator for depicting the problem of joblessness -- Proportion Unemployed Or Unemployment Rate?, News alert by Inclusive Media for Change dated 20th June, 2019, please click here to access Explained: Old reasons and new red flags in continuing auto slowdown -Yashee Singh, The Indian Express, 3 September, 2019, please click here to access Hardly the brick and mortar of a revival -Jayati Ghosh, The Hindu, 27 August, 2019, please click here to access For India Inc's sob story, Sitharaman has a sop story. But will it help? -Aunindyo Chakravarty, TheWire.in, 27 August, 2019, please click here to access Economic slump: Modi govt re-arranging furniture when house is on fire -Subodh Varma, Newsclick.in, 24 August, 2019, please click here to access Finance Minister Nirmala Sitharaman announces slew of measures for the auto sector, Moneycontrol.com, 23 August, 2019, please click here to access Auto sector slowdown hits scrap dealers, micro units in Coimbatore -M Soundariya Preetha, The Hindu, 22 August, 2019, please click here to access No hike in vehicle registration fee! Govt puts plan on hold amid slowdown, BusinessToday.in, 21 August, 2019, please click here to access Private sector salaries logged slowest growth in a decade -Vineet Sachdev, Hindustan Times, 21 August, 2019, please click here to access EVs to run on pink slips? -Abhijit Mukhopadhyay, Observer Research Foundation, 12 August, 2019, please click here to access Auto sector: Proposal to hike registration fees of new vehicles could aggravate slowdown -Nandana James, The Hindu Business Line, 5 August, 2019, please click here to access '2019 will be a challenging year for bus market', IANS, The Economic Times, 13 March, 2019, please click here to access Image Courtesy: UNDP India

|

Tagged with: Economic Downturn Economic Slowdown Buses Public Transport Automobile industry Economic deceleration

Write Comments